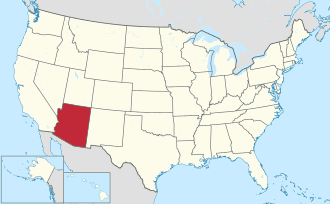

How Arizona Attorneys Can Earn CLE Credits with Podcasts: A Complete Self-Reporting Guide

Your Complete Guide to Using Audio Learning for Arizona MCLE Compliance

Arihant Choudhary

Founder, City

The Podcast Advantage for Busy Arizona Attorneys

If you're an Arizona attorney billing $300-500 per hour, traditional CLE seminars are expensive—both in fees and lost billable time. You're required to block 3-8 hours, travel to Phoenix or Tucson, and sit through content that may not align with your practice area.

There's a better way. Under Arizona Supreme Court Rule 45 and MCLE Regulation 104(B)(5), Arizona attorneys can earn up to 5 hours of their 15 annual CLE requirement through self-study, which explicitly includes "listening to audio reproductions" of CLE programs—that means podcasts.

Arizona's Self-Reporting System

Arizona does not pre-approve CLE providers or programs. According to the State Bar's official guidance, Rule 45 is "predicated on the assumption that attorneys can evaluate CLE activities offered based on the guidelines set forth in the Regulations, and report their activities by affidavit."

You are responsible for determining whether a podcast qualifies. The State Bar trusts Arizona attorneys to make this professional judgment.

What Makes a Podcast CLE-Eligible?

According to MCLE Regulation 104(A), any CLE activity must meet four standards:

Significant content with attorneys as the primary audience

Organized program directly related to law practice or professional responsibility

Appropriate setting conducive to learning

One-time credit (cannot re-claim same episode in future years)

The Written Materials Requirement

Critical requirement per Regulation 104(B)(5)(c): Written materials must be in your possession while listening and accessible for future reference.

This includes:

Episode transcripts

Show notes with case citations

Supplemental materials

Your own detailed notes (these count as written materials)

How to Calculate Hours

Self-study hours equal the actual time spent listening, rounded to the nearest quarter hour. A 30-minute podcast = 0.5 CLE hours. A 25-minute podcast = 0.4 hours (round to nearest quarter: 0.25 or 0.5 hours).

Important: Don't include advertisements or non-substantive introductions.

The 5-Hour Cap

You can earn maximum 5 CLE hours per year through self-study. The remaining 10 hours must come from live programs, interactive webinars, teaching, or writing.

Strategic approach:

Use 3 hours for ethics podcasts (satisfy your professional responsibility requirement)

Use 2 hours for substantive law in your practice area

Complete remaining 10 hours through live or interactive CLE

Documentation for Audit

The State Bar randomly audits affidavits. If selected, you must provide:

Purchase receipt or subscription confirmation

Your notes from listening (showing engagement with material)

File notes: date, program name, sponsor, topics covered

Copy of written materials (transcripts, show notes)

Best practice: Create a CLE tracking spreadsheet immediately after each episode. Log: date, episode title, provider, duration, topics covered, and location of written materials.

Common Mistakes to Avoid

Exceeding the 5-hour limit: Track self-study hours throughout the year. Once you hit 5 hours, switch to other CLE formats.

No written materials: Never listen without taking notes or downloading transcripts. Hours may be disallowed in audit.

Claiming same content twice: You can only claim CLE credit for an episode once. Mark episodes you've used.

Non-qualifying content: Entertainment podcasts, general business content, or programs where attorneys aren't the primary audience don't qualify.

Filing Your Affidavit

September 15 deadline. Log into your member account at login.azbar.org, enter all hours into your CLE dashboard, verify you've met requirements (15 total hours, 3 ethics minimum, 5 self-study maximum), and click "File Affidavit." Save your confirmation email.

Simply having hours on your dashboard does NOT constitute filing.

The Commute Strategy

Average attorney commute: 30 minutes each way = 5 hours per week. Your 5-hour self-study allowance = only 5 commutes. Front-load in July and you're done with self-study by August.

Many attorneys continue listening to legal podcasts beyond the 5-hour cap for professional development, even though they can't claim additional CLE credit.

Example: Using Research Club for Arizona CLE

Research Club's Federal Circuit Brief podcast delivers weekly 20-25 minute episodes analyzing Federal Circuit patent law decisions. Arizona attorneys can self-certify CLE credit for episodes covering:

PTAB procedures and IPR practice

Director discretion under 35 U.S.C. § 314

APJ recusal and judicial ethics

Secondary considerations evidence

Mandamus review standards

Each episode includes full transcripts, case citations, and show notes—satisfying the written materials requirement.

Example episodes:

"Motorola v. USPTO: When Policy Changes Kill Your Pending IPR" (25 min)

"Centripetal v. Palo Alto: When the PTAB Ignores Your Copying Evidence" (5 min)

Combined: 30 minutes = 0.5 CLE hours (substantive law)

The Bottom Line

Podcasts are a legitimate, cost-effective way for Arizona attorneys to meet MCLE requirements. The keys to success: understand the rules, document everything, track throughout the year, be conservative in claims, and file on time.

Arizona's self-reporting system empowers you to curate your own education, reduce costs, and transform your commute into professional development time.

About Research Club: We create CLE-eligible podcasts for patent attorneys covering Federal Circuit decisions and PTAB procedure. Visit researchclub.io for transcripts and documentation.

Disclaimer: This article provides general information about Arizona MCLE requirements and is not legal advice. Contact the Arizona State Bar MCLE Department for specific compliance questions.

Share on social media